5 Emerging Markets for Data Center Development

December 19, 2024

No matter which category you’re looking at—enterprise, colocation, or hyperscale—data centers are in high demand. Emerging and growing cloud, artificial intelligence (AI), and data providers are pushing data center development to new heights, requiring larger and more powerful builds than ever. This article takes a nationwide look at where data center development is booming while analyzing areas of opportunity for developers looking to break into new markets or expand within existing markets.

Data Center Market Growth

The U.S. has a well-established data center market—accounting for roughly 40% of the global market—and it’s expected to grow. According to McKinsey & Company’s analysis, demand for data centers is expected to reach 35 gigawatts by 2030 in the U.S. market alone.

Large technology and telecommunications companies occupy nearly half of the total data center space. But space is increasingly limited. Vacancy rates are declining globally, a challenge exacerbated by construction delays and less available power. Therefore, large corporations are finding it difficult to secure storage, making data center development a priority.

Competition is Rising in Data Center Development

Today, Northern Virginia, Dallas-Fort Worth, Chicago, and Silicon Valley have the largest data center markets by inventory in North America. These areas have historically high power supply and fiber availability, abundant natural resources, ideal environmental conditions, and local incentives to entice developers. However, developers are up against several challenges as they attempt to keep up with increased demand. In an already competitive market, developers also face:

- Power supply issues

- Regulatory and governmental pressures to build sustainably

- Tight labor markets

- High inflation

- Supply chain constraints

- Increased land prices and construction costs

To curb constraints and remain competitive, data center developers are exploring alternative submarkets. According to CBRE’s article, “Decoding data centers: opportunities, risks, and investment strategies,” Hillsboro, Oregon, Central Washington State, and Omaha, Nebraska, are emerging data center markets in the U.S. due to accommodating local governments and available power resources. Access to the grid and power availability are certainly important in data center development, but to be successful, developers also need affordable land that meets specific criteria.

Developers must first look in areas properly zoned for data centers to avoid regulatory pushback. Avoiding areas prone to natural disasters or flooding is also a must to limit the chance of damage that could take their data center offline for any amount of time. Developers should also understand a parcel’s proximity to nearby business communities to ensure they have the best workforce and resources to bring a data center online. Finally, developers will need to determine land buildability and select a data center site with the proper conditions, such as soil, slope, local habitats, and more, to ensure the success of development of such a caliber.

Land that meets the qualifying criteria can be difficult to find unless data center developers partner with GIS experts who know what to look for.

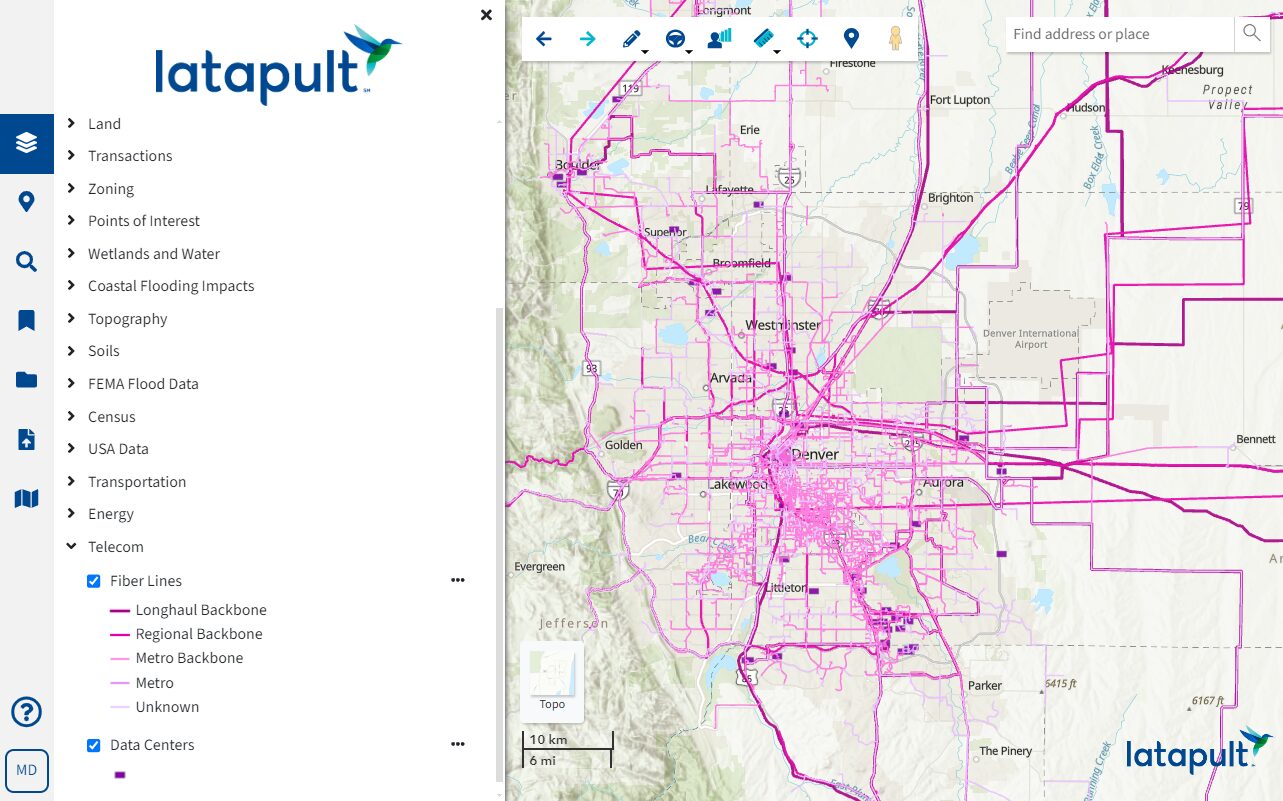

Finding Valuable Land for Data Center Development

Latapult’s GIS software brings to life the most up-to-date land data paired with easy-to-use mapping tools built on ESRI and Cotality. With 250+ data layers, developers can intuitively visualize even the most complex land information. Here are just some of the data layers and tools we offer to make data center site selection 50x faster than the competition:

- Fiber Lines Data: assists developers in understanding telecom and fiber connectivity nationwide to easily find and secure sites with the proper infrastructure for a data center to flourish.

- Energy Data: pinpoints necessary electric infrastructure for developers to determine property proximity to existing service areas, power and transmission lines, and substations.

- Natural Gas Pipelines Data: allows developers to view pipeline locations–a detail critical to deciding where to build.

- Property Information and Values: captures detailed parcel information for developers to assess property and building attributes based on ownership, value per acre, addresses, property and market values, transaction information, and more.

- Wetland and FEMA Flood Data: enables adaptive planning for potential risks by arming developers with insights into natural hazards.

- Soil Data: helps avoid detrimental soil types or exploitation of quality soil best suited for crops to balance the risk and reward of building.

- Topographic Data: determines land use with information on percent slope for the contiguous U.S.; four classifications of 0-5%, 5-10%, 10-25%, and greater than 25% slope; and USGS national elevation information.

- Census Data: gives a clear, concise breakdown of all demographics vital to the makeup of an area, like population, age, mode of transportation, migration, job industries, commute times, and more, for developers to determine local workforces and resources.

- Proximity Analysis: streamlines site evaluation by searching for property within a certain distance of necessary infrastructure.

- Buildable Area Analysis: Support site plans by visualizing usable acreage and buildable areas of a property based on slope, wetlands, flood zones, and more.

What’s Next?

Don’t have a subscription to Latapult? Connect with a GIS expert to learn how to use Latapult’s GIS mapping tools, plus others in our repository of 250+ data layers, to find effective land for your next data center development.

Want to explore new and upcoming markets? Connect with our support team to go deeper with Latapult.