Why It’s Hot: A Closer Look at the Texas Land Market

October 18, 2024

The Texas land market is hotter than ever, with the state attracting nearly 4 million new residents in the last decade. A diverse array of site selectors, developers, investors, and analysts are eager to capitalize on the state’s growth and various opportunities. From the bustling urban center of Houston to the scenic rural expanses of Hill Country and West Texas, the Lone Star State offers a fertile landscape for land acquisition and development.

Let’s dig into the factors that make Texas a prime destination for real estate development.

Industries Finding Success In Today’s Texas Land Market

Land development in Texas is predicted to grow to a $1.6 billion industry in the coming years. Nearly 95% of land in Texas is privately owned–approximately 80% of which remains undeveloped, according to Latapult’s calculations. Of the 268,820 square miles that make up Texas, three industries have found tremendous success in its vast lands.

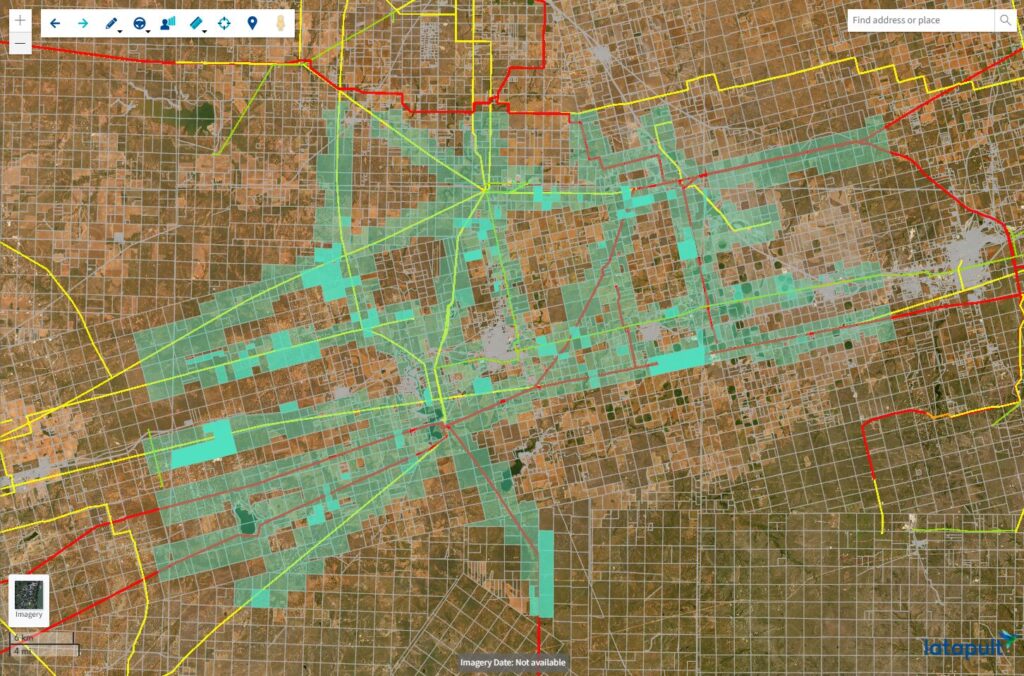

Texas leads the U.S. in wind power production and is second in solar power production, as of 2023. What’s more, roughly 15% of the U.S.’s electricity from all renewable energy sources in 2022 was generated in Texas. The driving force of this success? The deregulation of energy, state-wide energy grid, and federally funded financial incentives, including subsidies and tax credits. Latapult data shows that 74% percent of vacant land parcels in Texas are located near necessary electric infrastructure or in close proximity to power and transmission lines, and substations.

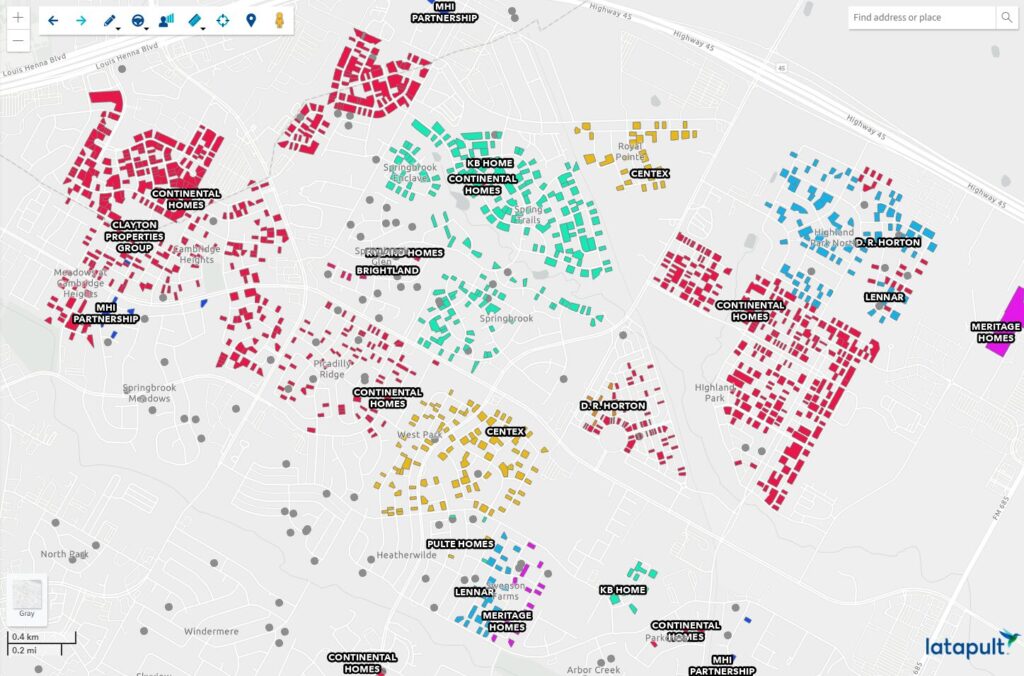

Residential developers and homebuilders are also experiencing success in Texas as nearly 86% of Texans live in urban areas, with population growth showing no sign of slowing. Texas consistently ranks high in the U.S. Census Bureau’s new residential construction data. But as the demand for housing rises, so does the rate of competition for quality land. Residential real estate developers need the ability to scope out the competition to properly execute the development of a subdivision or residential project without added pressure from the competition. For instance, Latapult’s data shows that about 44% of the subdivisions in Austin, Texas, are developed by major builders.

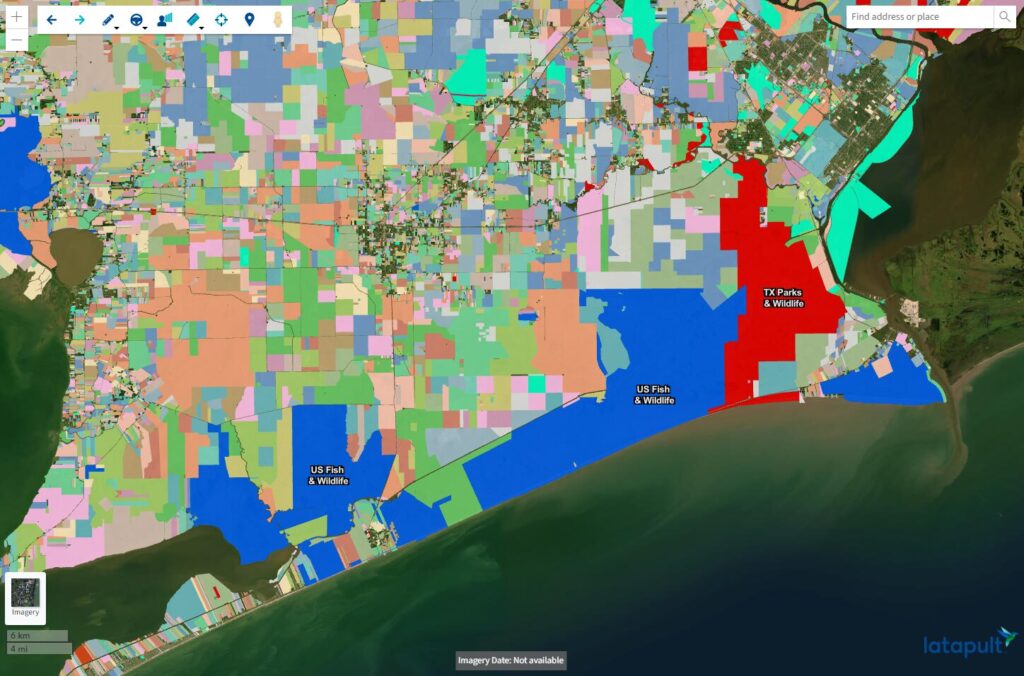

With a greater population also comes the need for commercial construction as business investments thrive. Texas acts as the headquarters to 55 Fortune 500 companies–more than any other state. The success of commercial real estate development teeters on the physical location of a property and how land features impact new builds. In Dallas, for example, Latapult shows there are currently over 94,000 undeveloped land parcels. However, on closer examination, 60% have substantial usable acreage for development based on slopes, wetlands, flood zones, and more.

Whether new to the market or looking to expand, developers across industries can find similar success, if they know where to look and how to evaluate land for the greatest opportunity.

Texas Hotspots For Land Acquisition and Development

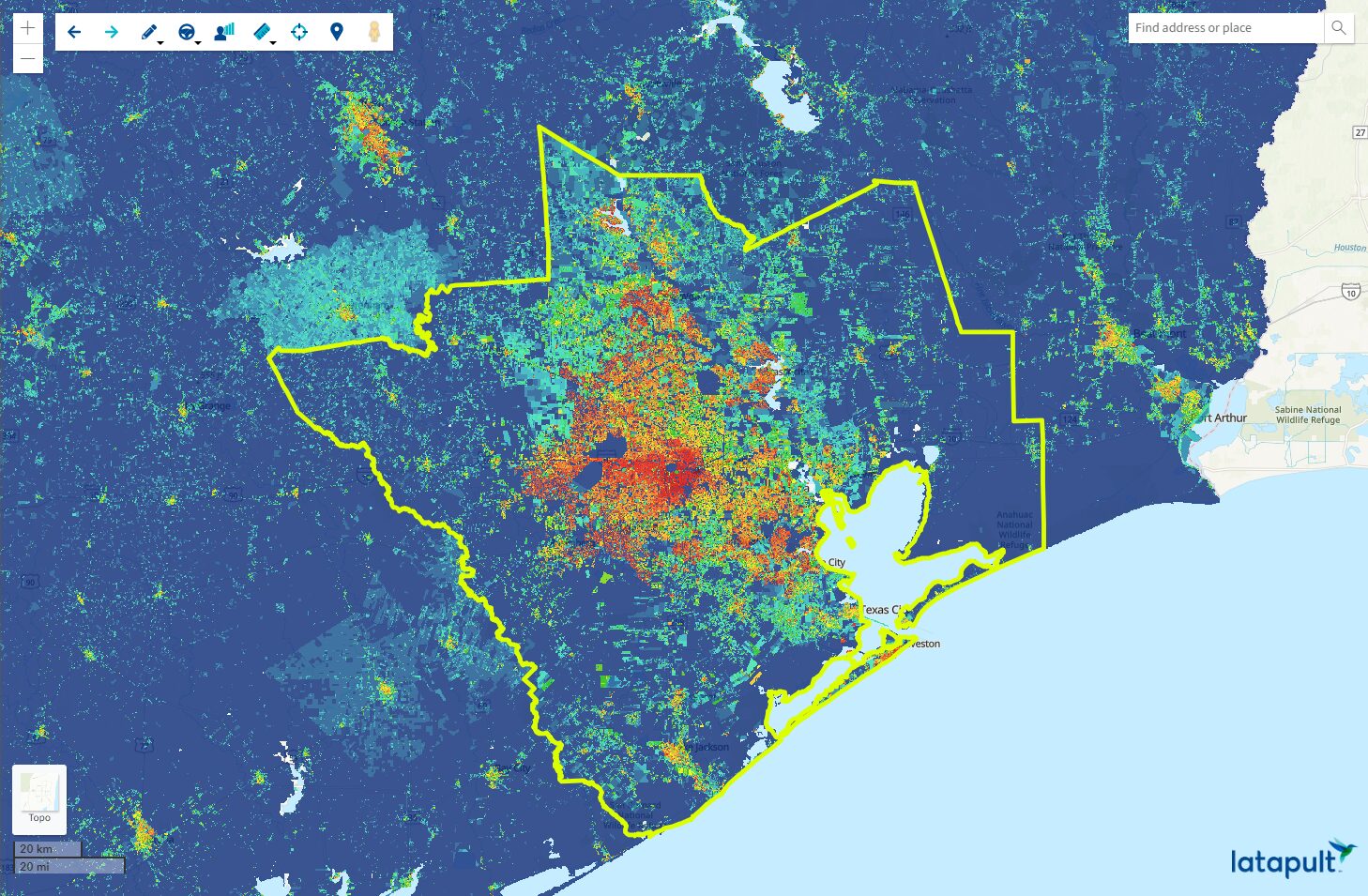

Dallas leads the nation in the most vacant land available for future projects, with 90,739 acres across more than 30,000 parcels, and Fort Worth, San Antonio, and Houston rank among the top five cities in the country with available land. However, depending on development goals and objectives, professionals can also find hidden land gems in rural and suburban areas such as Hill Country, West Texas, and East Texas, leading to greater return on investment.

Despite growth in Texas, developers may face an uphill battle as they try to secure financing, due to:

- Shifting regulatory landscapes, with zoning laws, land use regulations, and permitting processes becoming increasingly difficult to navigate

- Fluctuating property values and environmental concerns that could lead to considerable market risks

- Tightening financial conditions and uncertainty about future economic conditions

- Increasing competition for land, causing professionals to think quickly and act faster to acquire quality land

- Skyrocketing land values as the median price of land sits at $4,688 per acre as of 2024

In addition to market headwinds, some other major land characteristics could make or break a project, including:

- Land suitability that considers property size, location, and land type

- Presence of natural resource supplies

- Proximity to proper infrastructure, such as utilities, major roads, or electric infrastructure

- Driving distance to nearby urban amenities and necessary workforce

- Buildability of a parcel to determine project feasibility

Geographic Information System (GIS) software is a crucial tool for developers to analyze land quality and make informed planning decisions in Texas. From pinpointing prime locations for new housing developments to evaluating environmental impacts and infrastructure requirements, a robust GIS mapping platform, built on reliable data like ESRI and Cotality, can unify any land management process. Leaving no detail overlooked, GIS enables a deeper insight into market, demographic, environmental, and infrastructure trends, empowering land professionals to act on sustainable, high-return projects.

Utilizing GIS technology enhances project efficiency, validates investment strategies, reduces costs, and more effectively addresses the needs of Texas’s many communities.

Future Outlook of Texas’ Land Market Backed By GIS Data

Our geospatial experts analyzed the Texas land market using Latapult’s 250+ comprehensive data layers and found that in the past 2 years, the Houston MSA has the best price per acre for vacant land, making it a treasure trove of hidden land gems.

What’s Next?

Whether you’re looking to capitalize on the Texas land market or looking to dive deeper into your local or desired areas, speak with a GIS professional to get an expert opinion on any land market that interests you.